In a significant move to provide relief to the middle class and boost consumption, Finance Minister Nirmala Sitharaman, in her Budget 2025 announcement, revealed major changes to the income tax slabs. One of the most notable changes is the introduction of a higher income tax rebate, effectively eliminating tax liabilities for individuals earning up to ₹12 lakhs annually.

No Tax on Income Up to ₹12 Lakhs

As per the new income tax regime introduced for the fiscal year 2025-26, individuals with an annual income of ₹12 lakhs or below will not have to pay any income tax. This is a substantial improvement from the previous tax exemption threshold of ₹7 lakhs. The Finance Minister emphasized that this change aims to ease the financial burden on middle-class taxpayers, especially those earning around ₹1 lakh per month, who can now retain more of their income.

Revised Tax Slabs and Rates

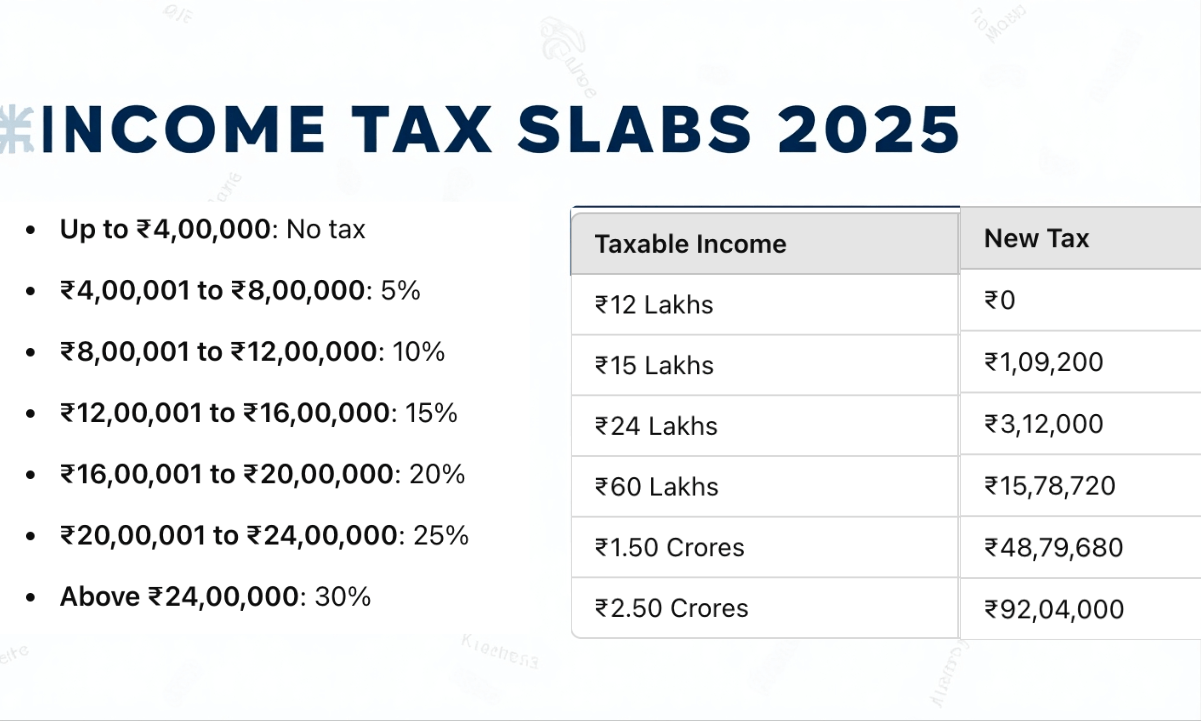

The new tax slabs, effective from FY 2025-26, have been revised to ensure greater tax relief, particularly for the middle-income group. The revised income tax rates under the concessional tax regime (CTR) are as follows:

- Up to ₹4,00,000: No tax

- ₹4,00,001 to ₹8,00,000: 5%

- ₹8,00,001 to ₹12,00,000: 10%

- ₹12,00,001 to ₹16,00,000: 15%

- ₹16,00,001 to ₹20,00,000: 20%

- ₹20,00,001 to ₹24,00,000: 25%

- Above ₹24,00,000: 30%

Additionally, the Finance Minister also announced that the standard deduction has been maintained at ₹75,000, ensuring further relief for salaried taxpayers. The increase in the income tax exemption limit is seen as a strategic step to boost disposable income, which can subsequently stimulate spending, saving, and investing in the economy.

Tax Benefits Across Income Levels

To provide a clearer picture, here’s a breakdown of tax savings for different income groups under the new tax regime:

| Taxable Income | Current Tax | New Tax | Tax Savings |

|---|---|---|---|

| ₹12 Lakhs | ₹83,200 | ₹0 | ₹83,200 |

| ₹15 Lakhs | ₹1,45,600 | ₹1,09,200 | ₹36,400 |

| ₹24 Lakhs | ₹4,26,400 | ₹3,12,000 | ₹1,14,400 |

| ₹60 Lakhs | ₹17,04,560 | ₹15,78,720 | ₹1,25,840 |

| ₹1.50 Crores | ₹50,11,240 | ₹48,79,680 | ₹1,31,560 |

| ₹2.50 Crores | ₹93,47,000 | ₹92,04,000 | ₹1,43,000 |

Key Changes in Tax Provisions

In addition to the new tax slabs, the government has also introduced other reforms to simplify tax provisions and enhance compliance. Some of these include:

- Rationalization of TDS/TCS provisions: The government has increased the TDS threshold for interest on securities and dividends, offering more relief to individual taxpayers.

- Tax Deduction for NPS Vatsalya Scheme: Contributions made to the NPS Vatsalya Scheme will now be eligible for an additional deduction of up to ₹50,000, promoting long-term savings for children.

- Simplified Taxation for Self-Occupied Properties: The government has simplified the taxation of self-occupied properties, where the annual value will be considered as NIL for up to two properties.

Future Outlook and Impact

With the proposed changes, the government aims to encourage tax savings and boost consumption, which is expected to have a positive impact on the economy. By reducing the tax burden on individuals and increasing disposable income, the government hopes to support the middle class and foster economic growth through higher domestic consumption.

The Finance Minister also hinted at a new income tax bill that will be introduced soon. The bill promises to simplify the existing tax structure and reduce litigation, thus offering greater clarity and certainty to taxpayers.

In summary, Budget 2025 brings substantial tax relief for middle-class individuals, especially those with earnings up to ₹12 lakhs. With these revisions, the government hopes to create a more efficient, responsive, and growth-driven tax system that benefits taxpayers across income groups.

Frequently Asked Questions (FAQ)

What are the new income tax slabs for FY 2025?

The new income tax slabs for the Concessional Tax Regime (CTR) under Budget 2025 are as follows:

- Up to ₹4,00,000: 0%

- ₹4,00,001 to ₹8,00,000: 5%

- ₹8,00,001 to ₹12,00,000: 10%

- ₹12,00,001 to ₹16,00,000: 15%

- ₹16,00,001 to ₹20,00,000: 20%

- ₹20,00,001 to ₹24,00,000: 25%

- Above ₹24,00,000: 30%

Additionally, taxpayers earning up to ₹12 lakh annually (or ₹12.75 lakh for salaried individuals with a standard deduction) will not need to pay any tax due to the rebate increase from ₹7 lakh to ₹12 lakh.

What is the new rebate limit in the 2025 Budget?

In Budget 2025, the government has increased the rebate limit under the Concessional Tax Regime (CTR) to ₹12 lakh from the earlier ₹7 lakh. This means that taxpayers earning up to ₹12 lakh annually (₹12.75 lakh for salaried individuals) will not pay any income tax.

How much tax will I save under the new income tax slabs?

Here’s a summary of the tax savings under the new tax slabs for various income levels:

- ₹12 lakh income: Tax reduced from ₹83,200 to ₹0 (Savings of ₹83,200)

- ₹15 lakh income: Tax reduced from ₹1,45,600 to ₹1,09,200 (Savings of ₹36,400)

- ₹24 lakh income: Tax reduced from ₹4,26,400 to ₹3,12,000 (Savings of ₹1,14,400)

- ₹60 lakh income: Tax reduced from ₹17,04,560 to ₹15,78,720 (Savings of ₹1,25,840)

What changes were made to TDS and TCS in Budget 2025?

Budget 2025 introduced several rationalizations in TDS and TCS provisions, including:

- TDS on interest: The threshold for TDS on interest (excluding interest on securities) has been increased to ₹10,000 from ₹5,000.

- TDS on dividends: The threshold for TDS on dividends has been raised to ₹10,000 from ₹5,000.

- TCS on remittances: The threshold for TCS on remittances under the Liberalized Remittance Scheme (LRS) has been increased to ₹10 lakh from ₹7 lakh.

These changes aim to simplify tax regulations for individuals and reduce compliance burdens.